Securing funding is a critical milestone for any project, but many entrepreneurs and project owners find themselves rejected by traditional funding providers. Understanding the reasons behind this rejection can help you prepare better and increase your chances of success.

In this blog, we’ll explore common reasons why traditional lenders decline funding requests and provide insights on how to overcome these obstacles.

1. Inadequate Business Plan

Traditional funding providers expect a clear, well-structured business plan that outlines your project’s goals, strategies, financial projections, and market analysis. A poorly written or incomplete business plan signals risk, making lenders hesitant to invest.

Solution:

Craft a detailed and professional business plan that addresses all potential questions a lender might have. Highlight your unique value proposition and show how your project stands out in the market.

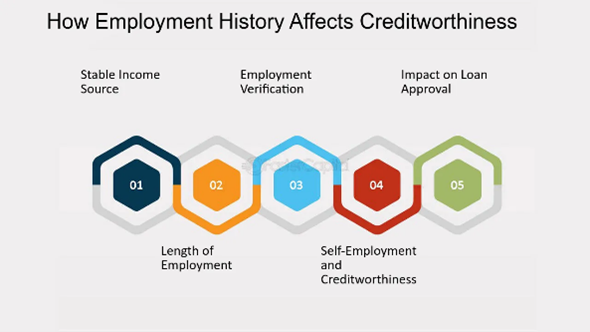

2. Lack of Financial History or Creditworthiness

Lenders often base their decisions on your financial history. If your credit score is low or you lack a proven track record, they may view your project as too risky to fund.

Solution:

Work on improving your credit score and maintaining detailed financial records. For startups without a financial history, demonstrate your expertise and the potential profitability of your project.

3. Insufficient Collateral

Traditional funding providers typically require collateral to secure their investment. If you lack tangible assets to back your loan, they may reject your application.

Solution:

Explore alternative forms of collateral, such as intellectual property or accounts receivable. Additionally, consider funding options that do not rely on traditional collateral, like venture capital or crowdfunding.

4. High-Risk Industry

Certain industries, such as tech startups or entertainment, are often deemed too volatile or unpredictable for traditional lenders. They prefer stable industries with lower risks.

Solution:

Emphasize how your project mitigates risks specific to your industry. Provide data, case studies, or expert endorsements that showcase the potential for success.

5. Unclear Revenue Model

If lenders can’t see how your project will generate income or repay the loan, they are unlikely to fund it.

Solution:

Clearly articulate your revenue model and demonstrate its feasibility. Include detailed financial projections to build confidence in your project’s profitability.

6. Overleveraged or Excessive Debt

If your business already carries a significant amount of debt, traditional lenders may be reluctant to provide additional funding.

Solution:

Reduce existing debt before applying for new funding. Highlight how the new funding will directly contribute to growth and profitability, making repayment easier.

7. Lack of Market Research

Without thorough market research, lenders may doubt your understanding of your target audience and the market’s demand for your product or service.

Solution:

Conduct comprehensive market research and include this data in your proposal. Demonstrate that your project aligns with market needs and trends.

Conclusion

Traditional funding providers are cautious and prioritize minimizing risks. By addressing their concerns—such as presenting a strong business plan, improving your creditworthiness, and conducting thorough market research—you can improve your chances of securing funding.

For those facing challenges with traditional lenders, alternative funding options like AMRE Finance can provide a tailored solution. AMRE Finance specializes in empowering innovative projects and entrepreneurs by offering flexible funding options designed to meet unique needs.

Ready to take your project to the next level? Discover how AMRE Finance can help you secure the funding you need. Learn More