“Do you have a compelling innovative idea that could create an impact in your community but you do not have a

bank statement, collateral, or pre-existing business to show to backers and get funding?”

Following the credit crunch and financial crisis of 2007-08, the world experienced a “reorientation of the regulatory and supervisory system to address head-on the problem of systemic risk” (‘Financial Regulation in the Wake of the Crisis, Governor Daniel K. Tarullo, 2009), tying the hands of traditional financial institutions and paving the way for the emergence of a new and disruptive fintech industry providing such solutions as crowdfunding, peer-to-peer lending, mobile money, cryptocurrencies, cashless remittance, and payment services, etc., to serve a customer base that these traditional financial institutions had let down.

Though the credit crunch was triggered by falling US house prices and a rising number of borrowers unable to repay their loans, it quickly trickled down to a point where capital markets went dry, and the flow of impact capital to Africa slowed down.

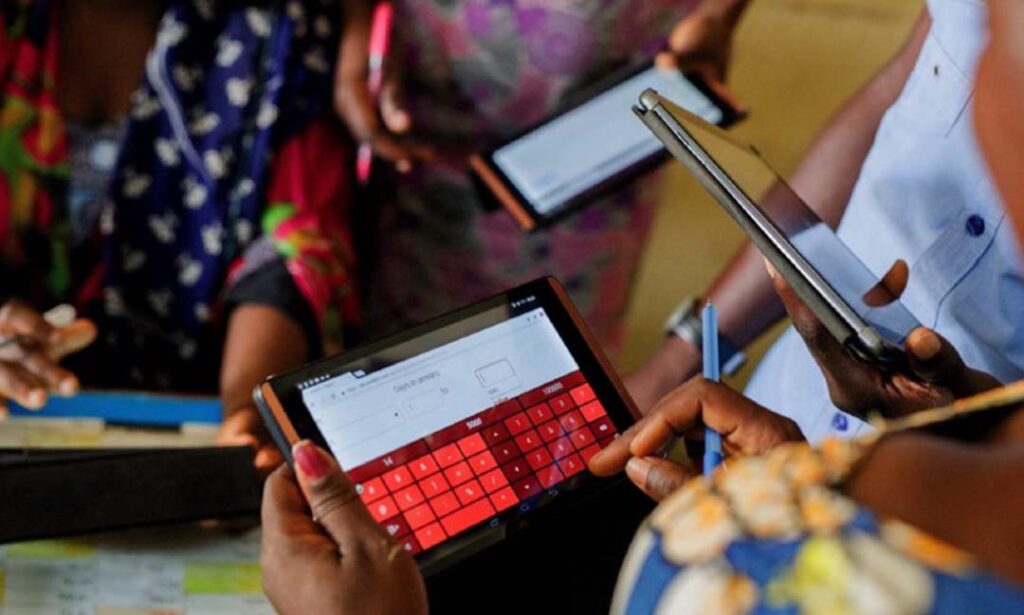

These fintech solutions have taken over a decade to gain ground in Africa due to technological gaps, archaic policies, and regulations that lagged behind the “arms race” of financial technology innovations leading to ‘bad’ actors exploiting the loopholes to extort and simply put, ‘scam’ vulnerable and uneducated retail customers of financial services.

The Rwanda Fintech Regulatory Sandbox is a good example of regulators chinning up and promoting innovation while at the same time closing the loopholes. In terms of digitalization, the fact that Rwanda now ranks 2nd in Africa in the fintech ranking, (‘Innovation Unleashed: Transforming Rwanda’s Financial Landscape posted on Forbs Africa, by Paula Ingabire, Minister of ICT and Innovation in Rwanda, and Nick Barigye, CEO of Rwanda Finance Limited, 2024) which is based on the Global Financial Centre Index, tells a story of a country that is putting in place the technological infrastructure required to win in the digital age.

AMRE Finance is not a first mover into this space and therefore has learnt from the mistakes of the fintech innovations that pioneered the movement in Africa. These mistakes span from “poor market research, inadequate financial planning, competition, team problems, or weak execution strategies.” (‘Insights to take from the Five Failed African Start-ups’ posted on LinkedIn, Eleny Kahsay, 2024). Moreover, Africa’s digitalization is on a roller coaster, and regulators are fast closing in on the loopholes, making AMRE Finance entry into the market very timely.

Impact entrepreneurs with creative ideas no longer need to have an existing business as a prerequisite to testing their business model, or better still, their theory of change. “Once the idea has gone through some validation and research, and has been morphed into a coherent business plan or pitch deck, it’s possible that plan can be funded…” (‘Will Investors Fund Just an Idea?’ Posted on startup.com, Wil Schroter, 2019).

Wil Schroter went further to suggest that “what [backers] want is some indication that this “idea” is better than any other idea, and the best way to separate it from the pack is to try to show the idea has merit with traction.” In other

words, “showing how [you] could… enlist a few early [beneficiaries] is what gets [backers] excited.”

Steps 1-3 of the AMRE Finance Creator Experience (cf appendix 1) set out to do exactly that, i.e. allowing creators to showcase their idea, theory of change, strategy, traction, budget, and team, in a bid to get backing from the community.

In conclusion, financial technology (fintech) and regulatory technology (regtech) have evolved to a point where innovative ideas can be incubated and hatched in a watertight jurisdiction such as Rwanda and a watertight platform such as the AMRE Finance platform with limited risk to the consumer and no unnecessary administrative bottlenecks to the creator.

This explains why AMRE Finance has chosen Rwanda as its regulatory jurisdiction and the highly regarded Rwanda

regulatory sandbox as its safety net.[backers] want is some indication that this “idea” is better than any other idea, and the best way to separate it from the pack is to try to show the idea has merit with traction.”